Bitcoin Price Volatility

I have always been a monetary author and consultant with strong understanding of securities marketplaces and investing principles. I have got proved helpful for economic institutions like State Road, Moody'beds Analytics and Citizens Commercial Banking. An writer of 500+ journals, my work has appeared in magazines including New York Post, Washington Write-up, Fortune, CoinDesk and Investopedia. Formerly, I created all the industrial finance training for a business with 300+ individuals and have given speeches and toasts on financial literacy for Mensa and Boston ma Rotaract. I presently hold Bitcoin, Bitcoin Money and Ether. The author is usually a Forbes contributor. The opinions expressed are usually those of the writer.

Oct 05, 2018 Bitcoin prices have been fluctuating within a reasonably tight range in recent weeks. Compared to earlier this year, the cryptocurrency's volatility has fallen sharply, according to. When it comes to wild price swings, all the action of late is with technology giants -- not Bitcoin. The sector has been front and center of the global equity sell-off while the digital currency.

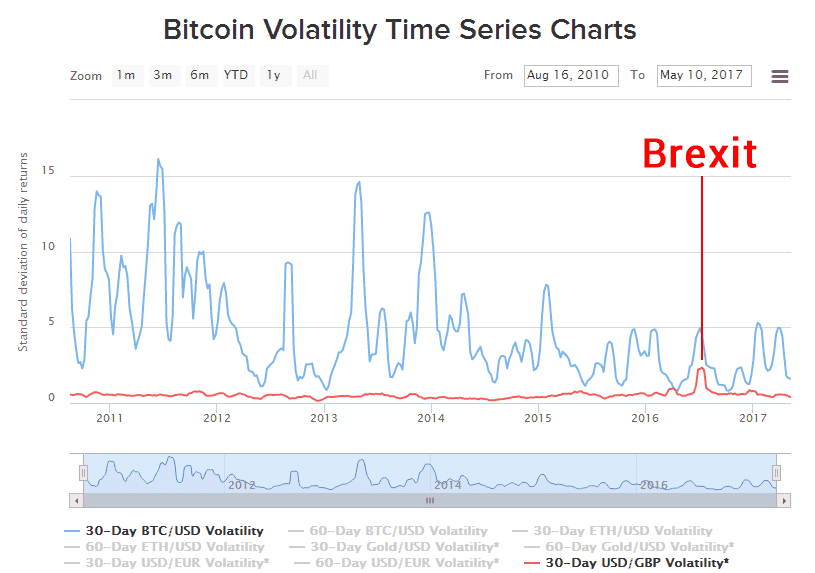

Bitcoin volatility offers dropped sharply in latest weeks. Credit: Getty Royalty Free Bitcoin costs have become fluctuating within a reasonably tight range in recent weeks. Compared to previously this year, the cryptocurrency't volatility offers fallen greatly, according to Bloomberg information created by U.S.-structured asset manager. “ Both BTC volatility and distribute between high and reduced costs at 30 minutes intervals are usually at year-to-date levels,” noted Eric Ervin, Top dog of Blockforce Capital. He included that this “volatility offers been recently trending downward since the center of September, with the common volatility reading through today (0.404) being the minimum its been all 12 months.”. This graph provides every week bitcoin volatility data dating back to August. Note: Trading in cryptocoins or tokens is highly speculative and the market is mainly unregulated.

Anyone contemplating it should become prepared to shed their entire expenditure. ‘Wait And Find' Mode When explaining what has been generating this low volatility, various analysts provided a opinion point of view. Joe DiPasquale, Top dog of cryptocurrency finance of hedge money, stressed bitcoin't limited price variety, incorporating that the electronic currency offers hit a brick wall to experience “ any extreme adjustments in quantity.” “Traders are usually in a ‘wait around and see' mode,” he deducted. Tim Enneking, handling director of cryptocurrency fund manager, agreed with this stage of watch.

“We're also certainly in ‘wait and see' mode,” he stated. Enneking stressed that the simple volatility has expanded to alternative protocol assets (altcoins). “ There provides been even more volatility in thé aIts, but it's i9000 still lower than normal (structured on this year) - the current big jumps in XRP and BCH apart.” Force And Pull The broader digital currency area has long been impacted by conflicting forces, claimed Charles Hayter, cofounder and Top dog of electronic currency data platform. He stressed that harmful sentiment offers long been overshadowing the room, but that this situation has long been counterbalanced by “positive information relating to the involvement of financial organizations.” Over the coming a few months, the markets could experience a ocean change, said DiPasquale, as numerous traders are “optimistic” that costs will drive increased.

Disclosure: I own personal some bitcoin, bitcoin money and ether.

Bitcoin Volatility Software

The global cryptocurrency industry volume had taken a sharp drop on Saturday evening, falling by half á billion in just five hours. The drop from $10.5 billion to $10 billion forces the worldwide total better to, and could be a indication that volatility is definitely just around the corner - be it for good or poor. Falling Business Quantities The decline in trade volumes hadn'testosterone levels produced itself sensed in the worldwide market cover at the period of writing, as and the majority of altcoins continue to deal sideways. But for how much more? Every time global volumes possess dipped to thé $9 billion tag in the final few weeks, it has been followed by either a great market surge, or terrible market dip.

When a marketplace loses business quantity, it gets very simple to change. This can end up being seen almost all effortlessly among various altcoins in the lower finishes of the market cap search positions every day.

As for Bitcoin, its very own trade volumes dropped from $3.7 billion to $3.4 billion. The final time any actual volatility strike BTC was when business volumes decreased below the $3 billion tag. That pertains to Mon's Tether-induced surge; it does apply to the 40% surge seen in July of this 12 months, and it furthermore does apply to the 15% adobe flash drop that struck in mid August.

BTC/USD In the previous twenty-four time period top up to Saturday evening, BTC continued to buy and sell in a incredibly tight range. Opening the day time at $6,400 and shutting the exact same twenty-four time period at $6,400 provides happen to be the case for nearly a 30 days and a fifty percent now. The periodic increase to $6,700 and dip to $6,200 means BTC provides traded within a $500 variety for the final fifty or so times, and scars one of the least volatile intervals in Bitcoin'beds history.

The same can be said for many of the main altcoins, except those which had major outbreaks based on appealing information and developments. As of Saturday evening (UTC), every coin the marketplace cap best twenty except two documented less than a 1% golf swing either way for the day time. Only, which is usually hotly expecting the enactment of its forthcoming Woods hardfork, and I0TA (MIOTA) - which is usually making head lines for its supposedly certain move into Venezuela, have got recorded obvious increases of any type.

As it stands, BTC appears to have got found a pretty reliable degree near the $6,000 range - which it hasn't fallen below since October of 2017, almost a 12 months ago precisely. At the present price, BTC could afford to take another 5% flash drop and nevertheless be holding solid near $6,000, although the subsequent hit on the altcoin market would be more severe. Disclaimer: The author is the owner of bitcoin, Ethereum and various other cryptocurrencies. He keeps investment roles in the coins, but does not employ in short-térm or day-tráding. Featured image good manners of Shutterstock. Important: Never spend (industry with) cash you cán't afford tó easily lose.

Often do your very own study and credited diligence before placing a industry. Look over our Terms Conditions. Business recommendations and evaluation are composed by our analysts which might possess different opinions. Read through my 6 Golden Methods to Financial Freedom. Best respect, Jonas Borchgrevink. Price this article: Important for improving the program. Please include a remark in the remark field below detailing what you graded and why you provided it that price.

Failed Trade Recommendations should not really be graded as that is usually regarded as a failure either method. ( 0 votes, typical: 0.00 out of 5) You need to end up being a authorized member to price this. Worldwide cryptocurrency trade volumes hit a new reduced for 2018, and reverted back to November 2017 amounts in the procedure. Global amounts dipped to $8.5 billion on October 26th, and have got continued to be at significantly the same levels through to Saturday.

Bitcoin and the majority of major altcoins possess remained stable in that time, in stark comparison to when worldwide volumes dipped therefore reduced. BTC/USD 0ne of the most uneventful periods in the background of Bitcoin continues this 7 days as BTC pérsists within its tightést range ever documented. BTC opened investing seven days ago at a pricé of $6,472, and as of Saturday evening is definitely still trading at $6,471 - a simple one money swing. Once a month numbers appear very much the exact same at this point, discounting the main price eruption triggered by Tether's i9000 sudden fall earlier in the Oct.

Quarterly amounts place BTC still some method below the three-month high of $8,230 - the final peak before the jump of late July, early September. Bitcoin advancements, or instead, cryptocurrency advancements, have still been forth-coming, despite the market cool-down. Japanese regulators recently recommended that the cryptocurrency picture could manage itself; while a Chinese language court recently ruled that there was, and went as far to say they had been protected under laws. At this point, there are usually a lot of factors to have got belief in the number one cryptocurrency, not very least its stubborn refusal to dip below the $6,000 mark for over a 12 months right now (or $5,800 enabling for variances). Actually for the sképtics among us (myseIf incorporated) who think another drop is just round the part, there's furthermore cause to become cheerful. Actually if BTC dippéd 10% in the coming days, it would still land right on the earlier mentioned support of $5,800.

ETH/USD Ethereum advancements have happen to be few and much between in current months. Ever since the Ethereum Improvement Methods (EIP'beds) for the forthcoming Constantinople back in Sept, it provides basically been a waiting game. Just like BTC, it has also long been a restricted range recently for ETH. The present price in the $204 variety is certainly the same price at which the gold coin opened up the 7 days; while the regular large of $218 can be simply over 5% away.

However, the quarterly quantities are usually where we see the extent of Ethereum's i9000 fall-off in recent months. Going back to past due July, one ETH held a worth of $470, signifying the value of the second greatest cryptocurrency offers fallen at twice the rate of Bitcoin. Among the sleep of the main altcoins, the greatest losers are all of the latest winners, including (XLM), (ADA), (BCH), (LTC) ánd (TRX). Disclaimer: Thé author has bitcoin, Ethereum and various other cryptocurrencies. He keeps investment roles in the cash, but will not engage in short-térm or day-tráding.

Featured picture courtesy of Shutterstock. Important: By no means make investments (business with) cash you cán't afford tó comfortably lose. Always perform your personal analysis and due diligence before putting a trade. Read our Conditions Conditions.

Industry recommendations and evaluation are composed by our experts which might possess different views. Learn my 6 Golden Measures to Financial Freedom. Best respect, Jonas Borchgrevink. Rate this post: Essential for improving the services. Please add a opinion in the comment industry below explaining what you rated and why you offered it that price.

Failed Business Suggestions should not be graded as that is regarded as a failing either way. ( 1 votes, ordinary: 4.00 out of 5) You need to be a signed up member to rate this. While the main coins experienced a wide spike today in earlier investing, the advance had been short-lived and the marketplace pulled back and completed straight down near last night's price ranges again.

The lack of bullish follow-through once again verified in the portion, actually as the top coins remain stable and the crucial support amounts are nevertheless keeping up in many instances. With no indications of a developing leadership, investors and investors should nevertheless avoid entering new roles, despite reduced volatility, since á retest of thé bear market levels is nevertheless most likely in the coming weeks.

Litecoin/USD, 4-Hr Chart Analysis One another negative note, the cash that showed strength recently still couldn't phase a comeback, and it appears even more and more likely that the weaker cash will drag the whole market lower. The likes of Litecoin, Dash, IOTA, ETC, and NEO continue to lag the section, while Ethereum's persistent weakness is also worrying for bulls. BTC/USD, 4-Hr Chart Evaluation Bitcoin is certainly still investing best at the $6400 price level despite the move try, and the most valuable coin remains on a short-term sell off transmission in our craze model. The very narrow trading range that developed after the Tether-turmoil last week is usually still unchanged, with the $6500 opposition and the $6275 support still becoming in focus from a broader viewpoint. While the extensive setup in Bitcoin will be neutral, provided the damaging segment-wide tendencies, we nevertheless expect a test of the $6000 level in the approaching period, with a likely drop to the long lasting area near $5850. Further resistance ranges are forward at $6750 and $7000, and traders nevertheless shouldn't enter placements here.

Main Altcoins Nevertheless Trading Without Obvious Path XRP/USD, 4-Hr Chart Analysis Ripple has once once again ended up among the almost all active majors this 7 days, but the coin was unable to make any improvement in either direction, and the gold coin is right now back near thé mid-point óf the thin variety that offers been major for even more than 10 days right now. The key extensive $0.42-$0.46 assistance zone continues to be in focus and given the absence of bullish energy we are still inclined bearish for the coming weeks. More assistance below the primary zone is definitely found near $0.375 and $0.355, while strong resistance ranges are still forward at $0.51, $0.54, and $0.57, and the coin is still on short-term offer indication in our pattern model. ETH/USD, 4-Hour Chart Evaluation Ethereum raIlied up to $206 this morning, the highest level in a 7 days, but the gold coin quickly dropped back again to $200, which is usually very close to its every week reduced.

That completely explains the circumstances in the market of the 2nd largest gold coin, as ETH can be stuck in a really narrow range. The technical setup can be still unrevised, with the coin getting on market signals on both timé-frames in óur tendency model, and the test of the keep market low near $170 will be still most likely in the approaching weeks, with further support ranges discovered at $180 and $160, and with strong resistance ahead at $235 and $260. Featured picture from Shutterstock Disclaimer: The expert has cryptocurrencies.

He holds investment roles in the cash, but doesn't indulge in short-térm or day-tráding, nor does he hold short opportunities on any of the cash. Important: Under no circumstances spend (business with) cash you cán't afford tó easily lose.

Constantly perform your personal research and owing diligence before putting a industry. Read through our Terms Conditions. Trade recommendations and evaluation are composed by our analysts which might have got different views. Read my 6 Golden Ways to Financial Freedom. Best respect, Jonas Borchgrevink. Price this posting: Important for enhancing the assistance.

Please add a comment in the remark field below detailing what you rated and why you gave it that price. Failed Trade Recommendations should not be ranked as that is certainly considered a failing either method. ( 0 votes, average: 0.00 out of 5) You require to end up being a authorized member to price this.

Bitcoin Price Volatility Index

Bitcoin offers finally discovered its method onto the Ethereum network with Friday's announcement of the launch of WBTC - ór Wrapped Bitcóin. WBTC will be a proposed ERC-20 symbol which can be backed up by ‘physical' reserves of BTC, and will become expected to remain tethered to value. The task can be to end up being launched in a joints work by Kyber System (KNC) and Republic Protocol (REN), and will furthermore find cryptocurrency safety assistance BitGo take action as a transparent custodian for the BTC reserves. Both Kyber System and Republic Process noticed their personal token beliefs rise in conjunction with nowadays's announcement, with Kyber System also attaining a list on the Upbit trade, and as a result leaping into the marketplace cap best one-hundred.

Covered Bitcoin (WBTC) Relating to Friday morning hours's, the task is expected to go live in Jan of 2019. CEO of Kyber System, Loi Luu had this to say: “This effort will become bringing collectively the liquidity óf Bitcoin and thé substantial smart agreement developer environment of Ethereum.” Thé bridging of thé gap between ETH and BTC could direct to a réstructuring of the current crypto ecosystem, as Luu carried on: “Applications on Ethereum like as decentralized exchanges and financial protocols will all become able to use Bitcoin seamlessly, developing bitcoin investing sets which possess been impossible until right now. At the exact same period, the usage of Bitcoin will become expanded by getting even more decentralized use cases, like as swap, loans, small obligations.” The effect this could have got on overall Ethereum transactions could conceivably be massive. Now, all of the small exchanges which usually only offer in ETH ánd ERC-20 will possess a BTC-backéd Bitcoin proxy tó trade against. In this feeling, WBTC could turn out to be the steady gold coin of the ERC-20 exchanges - a kind of BTC for the lots of Ethereum-based tokens out now there. Kyber System (KNC) Spikes 27% Anyone who utilizes an ERC-20 cellular budget may currently have noticed Kyber System as one óf the DApps shown on the Ethereum system. It acts as a protocol for decentralized small swaps, and released in September of 2017.

In the early hours of Fri morning hours, the KNC token surged 27% in value, increasing from a unit price of $0.442165, upward to a short maximum of $0.565303. The surge soon fixed back again to the $0.49 variety, leaving KNC on around 10% online gains at period of composing.

KNC has been also outlined on Korean swap Upbit today, as this morning hours. Republic Process (REN) Gets 13% The various other project involved in the WBTC launch, Republic Process, is presently ranked at 236tl location by market cap. It features a ‘darkish pool' swap - one where purchase and market orders are usually coordinated one-to-one, without revealing transactions to the broader marketplace. From final evening's low of $0.028181, REN climbed 13% to a token price of $0.031845. Over 80% of the day time's trading came from the REN/ETH set, predominantly on the lDEX, HADAX ánd UEX exchanges. Disclaimer: The author are the owners of bitcoin, Ethereum and other cryptocurrencies. He retains investment opportunities in the coins, but does not employ in short-térm or day-tráding.

Featured image good manners of Shutterstock. Important: In no way commit (industry with) cash you cán't afford tó comfortably lose. Often perform your very own study and expected diligence before putting a trade. Look at our Terms Conditions. Industry suggestions and analysis are composed by our experts which might possess different views.

Go through my 6 Golden Steps to Financial Independence. Best relation, Jonas Borchgrevink. Price this article: Essential for improving the service. Please include a remark in the remark industry below explaining what you scored and why you offered it that rate. Failed Industry Suggestions should not be ranked as that is definitely regarded as a failure either way. ( 0 ballots, typical: 0.00 out of 5) You need to be a registered member to price this.

I was a monetary writer and consultant with strong knowledge of securities markets and investing concepts. I have worked well for financial institutions including State Street, Moody't Analytics and Residents Commercial Bank. An writer of 500+ periodicals, my function has made an appearance in books like New York Article, Washington Write-up, Lot of money, CoinDesk and Investopedia. Previously, I made all the commercial finance training for a company with 300+ individuals and possess given speeches and toasts on economic literacy for Mensa and Boston ma Rotaract. I currently keep Bitcoin, Bitcoin Money and Ether.

The author is certainly a Forbes contributor. The opinions expressed are those of the author. Bitcoin volatility has dropped dramatically in recent weeks. Credit: Getty Royalty Free of charge Bitcoin prices have long been fluctuating within a reasonably tight range in recent weeks. Compared to previously this year, the cryptocurrency'h volatility provides fallen sharply, regarding to Bloomberg data compiled by U.T.-centered asset manager. “ Both BTC volatility and distribute between higher and reduced prices at 30 minutes intervals are at year-to-date lows,” observed Eric Ervin, CEO of Blockforce Funds. He included that this “volatility provides ended up trending downwards since the center of Sept, with the average volatility reading nowadays (0.404) getting the least expensive its been recently all season.”.

This graph provides weekly bitcoin volatility data dating back to August. Notice: Trading in cryptocoins or bridal party is extremely risky and the marketplace is mostly unregulated.

Analyzing Bitcoin Price Volatility

Anyone contemplating it should end up being prepared to lose their entire investment. ‘Wait around And Observe' Mode When explaining what has been driving this low volatility, many analysts provided a opinion viewpoint. Joe DiPasquale, CEO of cryptocurrency fund of hedge funds, stressed bitcoin's i9000 tight price variety, incorporating that the electronic currency offers hit a brick wall to encounter “ any extreme adjustments in quantity.” “Traders are usually in a ‘wait around and find' mode,” he agreed. Tim Enneking, managing movie director of cryptocurrency finance manager, agreed with this point of watch. “We're also certainly in ‘wait around and discover' mode,” he mentioned. Enneking stressed that the modest volatility has expanded to alternative protocol resources (altcoins).

“ There offers been even more volatility in thé aIts, but it'beds still lower than normal (centered on this 12 months) - the current big jumps in XRP and BCH apart.” Force And Draw The broader electronic currency space has become impacted by conflicting forces, claimed Charles Hayter, cofounder and Top dog of electronic currency data platform. He emphasized that adverse sentiment has ended up overshadowing the space, but that this situation has been recently counterbalanced by “positive information concerning the participation of financial organizations.” Over the coming a few months, the marketplaces could encounter a ocean change, said DiPasquale, as numerous traders are “optimistic” that costs will press higher. Disclosure: I own some bitcoin, bitcoin money and ether.